San Francisco Federal Credit Union is excited about our new Online Banking and Mobile Banking platform. On this page, you will find a series of frequently asked questions along with several How-to videos to assist you in using the system.

Online Banking

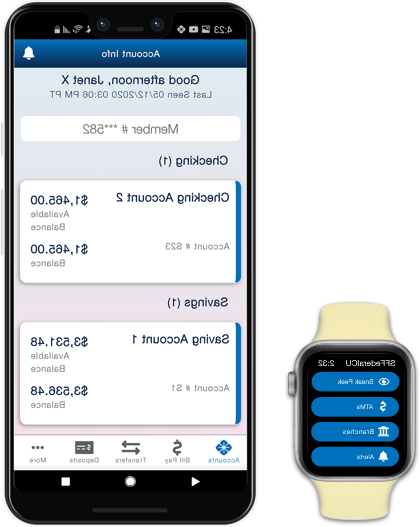

Mobile Banking

- Pay Bills

- Schedule or Cancel Payments

- Deposit Checks Faster

- Check Balances

- 24/7 Account Access

- Easily Transfer Funds

- Push Notifications

- Enhanced Security and Safety

Express Line Voice Banking

Express Line is an easy and convenient service which allows you access to your account 24 hours a day, seven days a week. By using Express Line, you are able to perform a variety of transactions, such as:

- Balance inquiries

- Account deposit and withdrawal inquiries

- Account transfers

- And more

24-Hour Telephone Banking 415-775-0171

Toll-Free Number 800-746-9600

If you believe you have been a victim of identity theft, read this Identity Theft Recovery Guide and please call us at 415-775-5377.

See How Digital Banking Works

Or select one of the videos

New Member Enrollment

New User Tutorial

Making a Transfer

Alerts and Notifications

Updating Personal Information

Updating Account Settings

Choosing Electronic Statements

Making Transfers on

Mobile Banking

Depositing Checks on

Mobile Banking

Account Transaction Details on

Mobile Banking

Digital Banking FAQs

This upgrade brings you an easy-to-use interface with many new features. Updated multi-factor authentication and passcodes offer the best security for your peace of mind.

Yes, you will need to delete the old 十大彩票游戏平台 app and download the new app from one of the app stores.

You can easily enroll from our home page. Simply click the “I Am a New User” link.

Once you are enrolled, fingerprint and face ID will be available depending on your device. The new platform will automatically identify the type of device you are using to log in and will present the correct options.

Username requirements are:

Must not be the same as your account number or password

Must be between 6 and 20 characters long

Must start with a letter

Password requirements are:

Must not be the same as your account number or username

Must be between 8 and 32 characters long

Must contain at least one numeric character

Must contain at least one letter

Must contain at least one special character

No. Bill pay and any recurring payments have been automatically converted to digital banking. A mobile phone number must be present on your account and cookies must be enabled for bill pay to link properly.

Apple iPhone / iPad / iPod:

To download the free mobile banking app, Apple members can visit the Apple App Store from your iOS device or click here to download San Francisco Federal Credit Union Mobile Banking app

Android:

To download the free mobile banking app, Android members can visit Google Play or check here to download the San Francisco Federal Credit Union Mobile Banking app.

The new vendor does not have this option available. We will be happy to assist you with this request over the phone at 415-775-5377 or you may visit one of our local branches.

Our current core system and the new online and mobile banking system are not compatible in this area. Once we go to the new core system this August, your full account number will be displayed within online and mobile banking. Until then, if you need your full account number, please call us at 415-775-5477 or visit a local branch.

We convert to our new digital banking solution soon.

For your safety and security, you will receive a one-time password (OTP) when you enroll and when you log in for the first time.

You will need to enroll as a new user. Simply click the “I Am a New User” link.

If you currently have any scheduled transfers (recurring or future-dated), those will automatically transfer to the new system.

Transaction alerts and balance alerts will automatically transfer to the new system. The alert configuration in the new digital banking system has significantly more options available, so we recommend reviewing the new settings in the system.

See instructions here regarding Quicken or Quickbooks users.

For online browsers:

Chrome, Edge, Firefox and Explorer, the current stable version and previous two versions (provided the browser maker supports those versions).

For mobile apps, minimum requirements are:

iOS: 11.0

Android: 5.0 (Lollipop API level 21)

Prior to changing to the new system, the Credit Union completed an analysis and identified that a very small population utilize this service and a decision was made to discontinue it. There are many services available for you and the Credit Union will continue to evaluate other products that we may want to introduce at a later time.

This feature will be available again when we complete our core system conversion this August. Our current core system and the new online and mobile banking system are not compatible in this area.